Across Europe on Monday, officials, voters and everyone else were trying to sort through the consequences of yesterday’s voting, across all 28 member-states, to elect the 751 members of the European Parliament.

Late Sunday, I began analyzing the results on a state-by-state basis — you can read my take here on what the European election results mean in Germany, France, the United Kingdom, Italy and Spain.

This post picks up where that left off, however, with a look at some of the results in Europe’s mid-sized member-states.

* * * * *

RELATED: A detailed look at the European parliamentary election results (part 1)

* * * * *

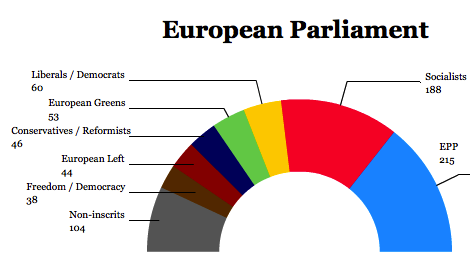

With the count now almost complete, here’s where the Europe-wide parties stand:

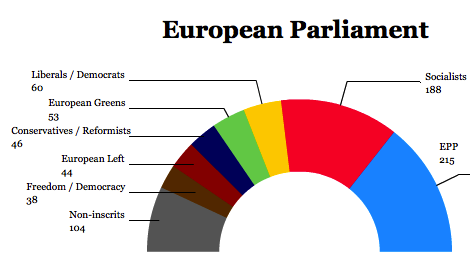

The European People’s Party (EPP), which has been the largest group in the European Parliament since 1999, will continue to be the largest group, but with fewer seats (215) than after any election since 1994.

The second-largest group, the Party of European Socialists (PES) has 188 seats, a slight gain, but not the breakout performance for which it was hoping.

The Alliance of Liberals and Democrats of Europe (ALDE) will remain the third-largest group, notwithstanding the collapse of two of its constituent parties, the Liberal Democrats in the United Kingdom and the Freie Demokratische Partei (FDP, Free Democratic Party) in Germany.

The European Greens have won 53 seats, just two less than before the elections. The Party of the European Left, which had hoped to make strong gains on the strength of its anti-austerity message, gained nine seats to 44.

The Alliance of European Conservatives and Reformists (ECR), a slightly eurosceptic group of conservative parties, including the Conservative Party of the United Kingdom, holds steady at 46 seats — that’s a slight loss of around eight seats. The Movement for a Europe of Liberties and Democracy (MELD) gained six.

The real increase was among the ‘non-inscrits,’ the unaffiliated MEPs, which will rise from around 30 to 104. The bulk of those MEPs include the newly elected eurosceptics that have made such a big splash in the past 24 hours, including Marine Le Pen’s Front national (FN, National Front) in France.

But, in addition to being a pan-European contest with wide-ranging themes that resonate throughout the European Union, the elections are also 28 national contests, and they’ve already claimed resignations of two center-left leaders — Eamon Gilmore, of Ireland’s Labour Party, and Alfredo Pérez Rubalcaba, of the Partido Socialista Obrero Español (PSOE, Spanish Socialist Workers’ Party).

Here’s a look at how the European elections are affecting nine more mid-sized counties across the European Union: Poland, Romania, The Netherlands, Belgium, Greece, the Czech Republic, Portugal, Hungary and Sweden.

Continue reading A detailed look at the European parliamentary election results (part 2) →

![]()