So much for ‘nice Nic’ — it’s not that he’s reverted back to ‘nasty Nic’ so much as ‘nonessential Nic.’

Fifteen days after his inauguration as Cyprus’s new president, Nicos Anastasiades (pictured above, bottom), was forced into what’s now become a growing domestic, eurozone and international crisis when European Union and International Monetary Fund leaders presented Anastasiades with a €10 billion bailout package.

The catch, of which you’re almost certainly aware at this point, is that an additional €5.8 billion of savings will come in the form of a one-time levy on all bank accounts in Cyprus — deposits of €100,000 will pay a 9.9% levy and deposits of under €100,000 will pay a 6.75% levy, even those deposits are insured by a system similar to the FDIC guarantee in the United States. Senior bondholders won’t take a haircut.

So if you’re a hedge fund, for now at least, you’ll receive fully 100% of the face value of any debt you hold in Cypriot banks. If you’re, say, a widowed Cypriot pensioner with €30,000 saved in a Cypriot bank, you’ll wake up Tuesday morning to find that you now have just €27,975.

It’s impossible to overstate just how politically explosive the plan was — in one fell swoop, Europe’s leaders have single-handedly done all of the following:

- undermined the Cypriot presidential administration just days after it was elected with the support of those same European leaders and a promise by Anastasiades that any bailout would not include deposit haircuts;

- provided ammunition to every euroskeptic in Europe from Beppe Grillo in Italy to Nigel Farage in the United Kingdom by reinforcing the notion that European institutions suffer from a lack of democratic legitimacy and gratuitously trample national sovereignty;

- pulled the rug out from under the financial industry in Cyprus, essentially the only growing sector in the Cypriot economy;

- handed to Cyprus’s parliament — where Anastasiades’s center-right Democratic Rally (DISY, Δημοκρατικός Συναγερμός or Dimokratikós Sinayermós), controls just 20 out of 56 seats — a strong reason to vote against the deal, thereby exacerbating the uncertainty throughout the week;

- undermined the concept of deposit insurance throughout the entire eurozone;

- by Europeanizing — or even internationalizing — what should have been a small matter in a country with a GDP ten times smaller than Greece’s, potentially initiated bank runs in Italy, Spain, and who knows where else throughout Europe;

- needlessly antagonized Russia in the process, and may have provoked Russia into making a politically explosive counter-offer to Cyprus; and

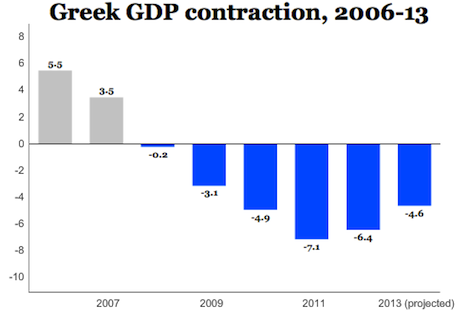

- probably did nothing to help Cyprus’s long-term economic outlook, because if the levy weren’t enough to depress Cypriot growth and undermine its banking industry, further austerity designed to reduce Cyprus’s public debt is certain to send Cyprus’s GDP swooning for some time to come.

That’s right — the first major decision of the Eurogroup of eurozone finance ministers since choosing as its president Jeroen Dijsselbloem, a center-left finance minister newly elected in the Netherlands just last autumn, is to demand an increase in the Cypriot corporate tax rate from 10% to 12.5% and a further increase on Cyprus’s savings tax.

That’s in addition to the deposit haircut that everyone’s mostly focused upon.

Anastasiades seems to have had very little option but to accept the deal, despite the fact that European leaders, including German chancellor Angela Merkel, actively supported his presidential bid in last month’s election:

[Anastasiades] spoke on Saturday of a ready-made decision imposed on Nicosia in the form of a blackmail: Take it or have the eurozone crumble….

In a written statement he issued on Saturday afternoon, Anastasiades said “Cyprus came across a previously made decision, a fait accompli.” In his defense he said that the emergency situation “did not arise in the last 15 days that we have undertaken the country’s administration.”

In the February 24 presidential runoff, Anastasiades won a landslide victory, with 57.48% of the vote to just 42.52% for health minister Stavros Malas, the candidate of the socialist Progressive Party of Working People (AKEL, Aνορθωτικό Κόμμα Εργαζόμενου Λαού or Anorthotikó Kómma Ergazómenou Laoú).

Anastasiades, in an address to the nation Sunday night, meekly argued that depositors would nonetheless receive bank shares in return for the one-time assessment and remained optimistic that recently discovered natural gas deposits in Cyprus might well boost Cyprus’s banks in the near future.

The political fallout for Cyprus

To the extent domestic politics is to blame for the current Cypriot crisis, AKEL is far from blameless — it’s unclear whether Cypriots will fault Anastasiades less than half a month into his administration more than his predecessor, Demetris Christofias, the country’s president from 2008 until last month.

Christofias and European leaders opened talks in June 2012 to secure a bailout, and Christofias even began to implement some small reforms, including a 5% VAT on food and drugs and an increase in the bank levy and tobacco taxes, but fell far short of European demands to reform public employment, the public pension system, and privatization of state-run industries in a country where unemployment has now risen to 14.7%.

In addition, the bailout talks were particular complex for other factors, including the outsized amount of the Cypriot banking sector’s debt, tied in large part to the Greek debt crisis. In addition, many Russian oligarchs have deposited money in Cyprus’s banks, and Cyprus has been scolded in the past for the facilitation of money laundering from less-than-pristine Russian sources.

With Merkel up for reelection in September, it would have hardly been palatable for her to push through a German-funded bailout of dodgy Russian depositors, which was apparent enough in the latest round:

Merkel’s Finance Minister Wolfgang Schäuble had gone to Brussels with a firm mandate from Berlin: “no bail-in, no bailout”, said a member of her government. That meant: unless depositors took a hit, there would be no agreement and Germany would not contribute towards a package for Cyprus.

So talks never quite progressed, and with Cyprus facing imminent sovereign default, Anastasiades came rather easily to office with a plan to renew those talks, though he repeatedly refused to accept a deposit haircut of the kind now being implemented.

Although today was a bank holiday in Cyprus, banks were initially set to close on Tuesday, but will now be closed until Thursday as well, as the Cypriot parliament has repeatedly delayed taking up debate on the Cypriot package.

Anastasiades’s DISY, as noted above, controls just 20 out of 56 elected seats in the Cypriot House of Representatives (Βουλή των Αντιπροσώπων) and AKEL controls 19. The centrist Democratic Party (DIKO, Δημοκρατικό Κόμμα or Dimokratikó Kómma), which backed Anastasiades in the presidential race, controls another nine seats. Three additional parties that largely supported the center-left, independent Giorgos Lillikas in the presidential election control an addition eight seats, including five by the Movement for Social Democracy (EDEK, Κίνημα Σοσιαλδημοκρατών or Kinima Sosialdimokraton).

That means that if AKEL, EDEK and other small parties oppose the deal, DISY and DIKO hold just of 29 votes, just enough to pass the Cypriot package without any defections.

Moreover, DIKO’s leader has already called for changes to the bailout legislation, and it looks increasingly like Anastasiades lacks the support to win a vote in parliament, which means that European leaders will have to renegotiate the previous deal. It’s not clear how much time Cyprus has before its banks (or its government) become insolvent.

Cold War redux?

Meanwhile, Russian president Vladimir Putin denounced the decision as ‘unfair, unprofessional and dangerous.’

Russia hasn’t indicated whether it will extend or otherwise change the terms of an existing €2.5 billion loan to Cyprus — if Russia refuses to extend the loan for another five years, the Cypriot bailout will need to be even larger. So there’s that.

I wouldn’t be surprised if Anastasiades and members of the Russian government are discussing an alternative to the current European-IMF plan — the Republic of Cyprus, which occupies the southern half of the island of Cyprus, is not a member of the North Atlantic Treaty Organization, and a €17 billion bailout would be a small price for Russia to pay in exchange for closer military ties or a Russian naval base on the island.

Perhaps even more tantalizing for Russia, and its state-owned natural gas company Gazprom, are newly discovered natural gas deposits that Cyprus hopes will fuel future economic growth. Indeed, there are already vague reports of a Russian counteroffer — the official Russian news agency seems to indicate that emergency talks have now been initiated:

Russia’s Gazprom has not offered the Republic of Cyprus financial assistance in restructuring the country’s banks in exchange for the right to gas production in the exclusive economic zone of Cyprus. Gazprombank initiated this offer, a spokesman for the gas giant told Tass.

That result would cause dismay among the United States and its European and NATO allies which, by the way, includes Turkey. Turkey has occupied the northern half of the island of Cyprus since the 1970s — the Turkish Republic of Northern Cyprus declared its independence from the Greek Cypriot republic to the south in 1983, and the two have remained divided ever since. So what’s an economic crisis and a domestic political crisis could also become a geopolitical security crisis soon enough.

The economic and political fallout for the eurozone

Reaction from economic commentators has been essentially universally negative since news broke early last weekend. Continue reading What comes next for Cyprus and the EU following Friday’s haircut ‘bail-in’? →

![]()