It’s really quite incredible that there’s been more ink spilled over the decision of the American Studies Association, a US-based academic group, to boycott Israel than the potential nomination of Stanley Fischer, the former governor of the Bank of Israel, to become the next vice chair of the US Federal Reserve.![]()

![]()

It’s somewhat ironic that at a time when many critics are attacking the ASA’s decision (is it morally right to boycott the exchange of ideas, academic debate and discussion?), Fischer’s transition from Israeli central banker to US central banker would be a spectacular opportunity — for Fischer, for the Fed, for Israel, for the United States and, if the initial reaction holds, world markets, too. Reuters reported late last week that Fischer was offered the spot, though there’s not been an official announcement.

Janet Yellen, the current Fed vice chair, is US president Barack Obama’s nominee to chair the Fed after Ben Bernanke completes his second term on January 31, 2014, and she is expected to be confirmed as the new Fed chair by the US Senate in a vote later this week.

Fischer, as the number-two official at the Fed, would bring with him eight years of experience setting monetary policy for Israel and the rock-star status of one of the world’s most accomplished economists. As a longtime professor at the Massachusetts Institute of Technology, he not only served as thesis supervisor to Bernanke, the current Fed chair, but also Mario Draghi, the chair of the European Central Bank.

As The Financial Times reported last week, Fischer has a ‘dream resumé’ for the position, topped off by an eight-year stint as Israel’s central bank governor that is universally acclaimed:

Some clues to how Mr Fischer thinks about monetary policy come from his tenure as governor of the Bank of Israel. He was one of the country’s most respected public figures; when he announced he would be stepping down earlier this year, one commentator said the country was losing its last ”responsible adult”.

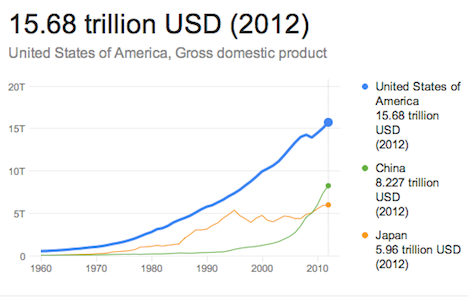

His eight years as governor coincided with fast economic growth, low unemployment – currently 6 per cent – and low inflation. Israel survived the financial crisis in 2008-9 without seeing a single bank collapse. Unlike his predecessor Jacob Frenkel, who had a tight focus on fighting inflation, Mr Fischer is credited with broadening the Bank of Israel’s remit to influence growth and employment. His decisions were marked by pragmatism: he slashed interest rates in the wake of the financial crisis, then abandoned economic dogma to try to hold down Israel’s currency, before raising rates as the economy recovered.

Fischer was so successful in stabilizing Israel’s economy that the Bank of Israel was already raising interest rates by September 2009 — if it hadn’t been for his age (he’s 70 today), he would have been a strong candidate to succeed Dominique Strauss-Kahn as managing director of the International Monetary Fund in 2011.

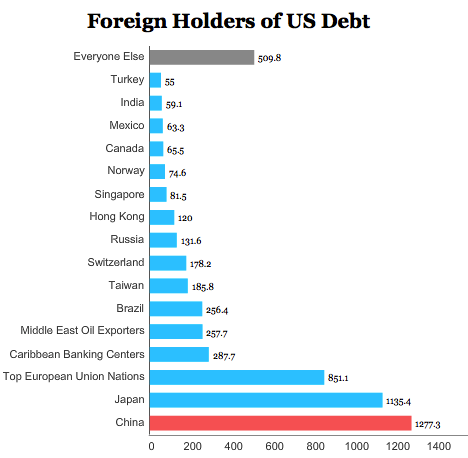

Born in what is today Zambia, Fischer spent his childhood there and in what is today Zimbabwe (and what was then the colonial apartheid state of southern Rhodesia). Fischer first came to the United States in 1966 for his Ph.D in economics at MIT, and he remained there as a professor through 1988, when he took a position as the World Bank’s chief economist for two years. From 1994 to 2001, he served as the first deputy managing director of the IMF during the Asian currency crisis of the late 1990s and other financial crises from Mexico to Argentina to Russia. After a brief stint in the private sector with Citigroup, he was appointed governor of the Bank of Israel in 2005 by then-prime minister Ariel Sharon — and recommended by the finance minister at the time, Benjamin Netanyahu. He holds dual Israeli and US citizenship, and he would have been as credible a candidate to lead the Fed as either Yellen or former treasury secretary Lawrence Summers.

As Dylan Matthews wrote earlier this year for The Washington Post, Netanyahu and Sharon took a big chance on Fischer, who wasn’t an Israeli citizen at the time of his nomination:

No matter — Fischer’s results were more than enough to assuage any doubts. No Western country weathered the 2008-09 financial crisis better. For only one quarter — the second of 2009 — did the Israeli economy shrink, by a puny annual rate of 0.2 percent. That same period, the U.S. economy shrank by an annual rate of 4.6 percent. Many countries, including Britain and Germany, fared even worse.

So what would his appointment mean for the Fed? Continue reading Why Stanley Fischer is such an inspired choice as US Fed vice chair