In case you missed it over the weekend, China’s state-run newspaper Xinhua printed an extraordinary editorial calling for a turn to a ‘de-Americanized’ world that appears to have had the support of the top leadership within the world’s most populous country:![]()

![]()

As U.S. politicians of both political parties are still shuffling back and forth between the White House and the Capitol Hill without striking a viable deal to bring normality to the body politic they brag about, it is perhaps a good time for the befuddled world to start considering building a de-Americanized world….

The tone only sharpens as the editoral blames the United States for torturing prisoners and killing civilians in drone attacks before fully condemning the era of ‘pax Americana‘:

Moreover, instead of honoring its duties as a responsible leading power, a self-serving Washington has abused its superpower status and introduced even more chaos into the world by shifting financial risks overseas…

Most recently, the cyclical stagnation in Washington for a viable bipartisan solution over a federal budget and an approval for raising debt ceiling has again left many nations’ tremendous dollar assets in jeopardy and the international community highly agonized.

Elements of the editorial are somewhat biased — a self-serving ding against Washington for ‘instigating regional tensions amid territorial disputes’ is more reminiscent of Chinese bluster and blunder on relations with Taiwan, Hong Kong and Tibet, as well as the recent territorial dispute with Japan over the Senkaku/Diaoyu Islands. But if, as is almost certainly the case, the editorial has the backing of top Chinese leadership, it will be the strongest call to date for a move to a ‘de-Americanized’ world.

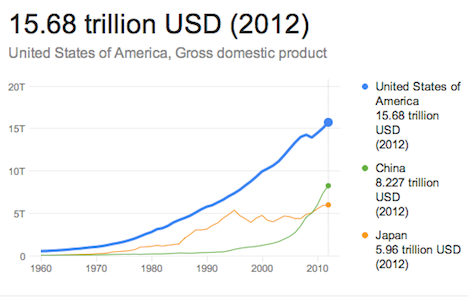

It’s important to keep in mind that, for all the defeatist talk that China has eclipsed the United States, the US economy remains roughly twice the size of the Chinese economy:

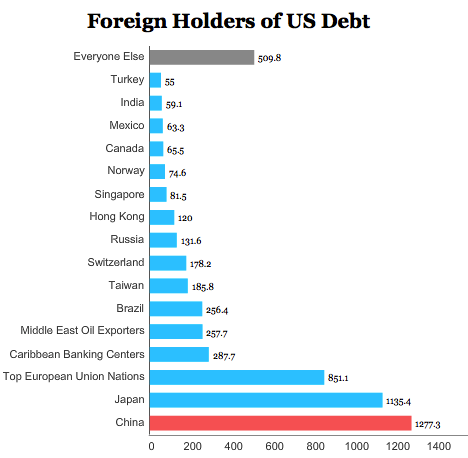

Furthermore, for all of the talk that the United States is becoming ever-more indebted to the Chinese, it’s also important to keep in mind that of the $16.7 trillion or so in outstanding US debt issuance, around $4.7 trillion amounts to intergovernmental holdings (e.g., amounts held by the US Federal Reserve). Another significant chunk of that debt is held by state and local pension funds, the Social Security Trust Fund. In fact, as of July 2013, foreign governments held just $5.59 trillion of the debt, and China held just $1.277 trillion of it, while Japan held nearly as much with $1.135 trillion. Here’s a closer look at the breakdown of the foreign holders of US debt:

In all the loose talk about China’s rise, it’s easy to lose track of those two items — China holds just over 7.6% of all US debt and its economy is just 52.5% the size of the US economy.

So while China isn’t today in a position to issue edicts about the de-Americanization of the world economy, its views are becoming increasingly influential, especially as it takes a greater investment role within the world from Latin America to Africa. Its call for developing and emerging market economies to play a greater role in international financial institutions like the World Bank and the International Monetary Fund mean that the days of an always-American World Bank president and an always-European IMF managing director are numbered.

Even in the worst-case scenario in which the US Congress’s failure to lift the debt ceiling leads to another Lehman-style panic, China can’t do much immediately to bring about a de-Americanized world. But, like Humphrey Bogart’s warning to Ingrid Bergman in Casablanca, the threat will come ‘maybe not today, maybe not tomorrow, but soon — and for the rest of your life.’

So when China makes noise about a de-Americanized world, it essentially means two things: a world where US debt is no longer perceived as the world’s safest investment and the US dollar is no longer the world’s reserve currency. I’ll take a look at each in turn, but first, it’s worth making sure we’re all on the same page as to the basics of the debt ceiling standoff itself.

The debt ceiling crisis

US treasury secretary Jack Lew has pinpointed October 17 as the day that the United States will be truly jeopardized by its failure to raise the debt ceiling (currently at $16.7 trillion).

With about 24 hours to go until the world hits that deadline, the Republican Party, which controls a majority of the votes in the US House of Representatives, are nowhere near approving a bill that, with or without conditions, would raise the debt ceiling for even a short period of time, and the US Senate, which is controlled by the Democratic Party, will spend Wednesday taking the lead on a last-ditch effort at negotiations between Senate majority leader Harry Reid and Senate minority leader Mitch McConnell.

It’s reassuring to know that Moody’s isn’t quite as pessimistic about the October 17 deadline — in a memo from earlier this month, Moody’s experts argued that the US government could quite possibly hobble along, quite possibly until November 1, when a slew of entitlement spending means that the US government will be unlikely to meet its obligations on time. The US government will certainly prioritize interest payments on US debt and meet its other obligations on the basis of incoming revenues. But the clock’s ticking, and while Wall Street and global markets seem nonplussed about the shutdown and even about the October 17 debt ceiling deadline, there’s no way to know when that could change.

Market sentiment is a tricky thing to forecast — recall the speed in 2008 with which former US treasury secretary Hank Paulson went from worrying about the moral hazard of bailing out Lehman Brothers on September 14 to, less than 24 hours later, worrying about rescuing the entire financial system from a global panic. While it seems unlikely that markets will immediately tank at midnight tonight if the US Congress fails to act on the debt ceiling, there are signs that other actors in the global economy are running out of patience. One of the other top three credit ratings agencies, Fitch, put the United States on warning Tuesday by lowering the outlook on its ‘AAA’ credit rating from ‘stable’ to ‘negative,’ citing the brinksmanship in the US political system that’s so far failed to secure a debt ceiling hike.

For those of you who might have been living on a deserted island for the past three years, the US Congress is generally obligated to raise the total aggregate amount of US debt issued, irrespective of whether the US Congress has approved the spending levels associated with issuing such additional debt. No other country (except Denmark) has a similar concept, which is why the debt ceiling crisis is such a foreign concept for non-Americans.

Between 1798 and 1917, the US Congress had to approve every single issuance of new debt; the onset of the ‘debt ceiling’ concept was initially a way to streamline debt issuance during World War I. Since 1917, the US Congress raised the debt ceiling over 100 times, and 14 between 2001 and 2013. Traditionally, in times of divided US government, though those votes have sometimes been subject to one party’s political posturing. US president Barack Obama himself cast a vote against raising the debt ceiling in 2006 when he was just a US senator, and he issued some pious, if garden-variety, blather about ‘shifting the burden of bad choices today onto the backs of our children and grandchildren.’ Matt Yglesias at Slate called out Obama for ‘bullshitting’ back in 2006.

But only in 2011 did one party seek to wield the debt ceiling as a weapon of economic destruction — give us what we want on our policy priorities or the world economy gets it! In 2011, just months after Obama’s party suffered devastating losses in the November 2010 midterm elections, Obama agreed to make budget cuts in exchange for a hike in the debt ceiling. But now, fresh off reelection, Obama is arguing that he won’t negotiate over the debt ceiling — partly to discourage anyone from trying to use the debt ceiling as an instrument of political blackmail in the future.

In any event, for the best reporting in the United States on the debt ceiling crisis in terms of both politics and policy, go read Ezra Klein (and friends) at Wonkblog at The Washington Post and every word that Robert Costa at National Review reports from within the House and Senate Republican caucuses.

But it’s vitally important to the global economy because US debt — Treasury debt securities (called ‘Treasurys’) and, specifically 10-year Treasurys (called ‘T-notes’) — is generally viewed as the safest investment in the world.

Why US Treasurys are so special

As Felix Salmon at Reuters memorably explained Tuesday, US-issued debt is the ‘risk-free vaseline which greases the entire financial system’:

If Treasury payments can’t be trusted entirely, then not only do all risk instruments need to be repriced, but so does the most basic counterparty risk of all. The US government, in one form or another, is a counterparty to every single financial player in the world. Its payments have to be certain, or else the whole house of cards risks collapsing — starting with the multi-trillion-dollar interest-rate derivatives market, and moving rapidly from there.

Salmon continues to write that, even if the US Congress passed a ‘clean’ bill raising the debt ceiling on October 16, it will still have caused significant doubt in the trust of global markets in US debt:

The vaseline, in other words, already has sand in it. The global faith in US institutions has already been undermined….

While debt default is undoubtedly the worst of all possible worlds, then, the bonkers level of Washington dysfunction on display right now is nearly as bad. Every day that goes past is a day where trust and faith in the US government is evaporating — and once it has evaporated, it will never return. The Republicans in the House have already managed to inflict significant, lasting damage to the US and the global economy — even if they were to pass a completely clean bill tomorrow morning, which they won’t. The default has already started, and is already causing real harm. The only question is how much worse it’s going to get.

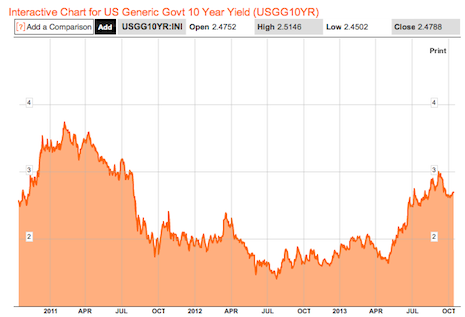

What’s perhaps most interesting is the almost instinctive role that Treasurys play for global investors. Even though the 2008 global financial panic had roots in the United States and the subprime mortgage crisis, investors still flocked to Treasurys, because they have historically been a refuge for global investors in times of financial turmoil. In the summer of 2011, as the United States faced a previous fight between House Republicans and Obama over raising the debt ceiling, the yield on 10-year Treasurys actually fell — and yields on 10-year Treasurys have fallen again slightly in recent days as we approach the debt ceiling deadline. Here’s the 10-year Treasury yield over the past three years — it peaked at 3.74 in February 2011 and it hit a low of 1.38 in July 2012:

It’s not inconceivable that, in the short run, any global financial crisis precipitated by the risk of US sovereign default (from the failure to raise the debt ceiling) would result in pushing yields even lower. So even in a crisis whose proximate cause is the unreliability of US debt, global investors might still respond by buying up more US debt as a safe haven simply out of habit. In the long run, however, it’s difficult to believe that global investors will give the United States the chance to be in that position if they perceive the United States to be ungovernable.

That, alone, would make the US fiscal outlook over the coming decades more troubling — when the world is clamoring to buy up US debt, it pushes down yields. To put it another way, everyone in the global economy is bidding down everyone else in the global economy for the privilege of parking their capital in Treasurys because they’re perceived to be the safest investment in the world. When the world no longer considers Treasurys quite so safe, yields will rise, and the United States will pay much, much more in order to borrow in the future. The world we live in today is a world where US budget deficits are subsidized by the fact that US debt is such an attractive and predictable investment. (That’s why neo-Keynesian economists like Paul Krugman argue that the United States should have borrowed even more over the past four years, while yields were so low, to pay for infrastructural upgrades to US roads, bridges, railways and airports, arguing that future US governments will ultimately borrow in the future to do so, and they could pay significantly higher yields at that point.)

But almost everyone agrees that the United States faces a challenging fiscal puzzle over the next decade or two, in light of its rapidly aging population. That means that the United States will have to find a way to reduce its spending on Social Security and other retirement pensions, Medicare health-care expenses for the elderly and other government obligations. It also means that the United States may also have to raise the US tax burden, through increases to the US income tax rate or otherwise.

In a future where global investors don’t turn to US Treasurys as a matter of instinct, it will make it that much harder for the United States to borrow at low rates, and therefore, a debt ceiling crisis today could make tomorrow’s fiscal choices even more difficult.

The US dollar as a reserve currency

If the debt ceiling showdown becomes a full-blown crisis, it could even challenge the supremacy of the US dollar as the world’s reserve currency — it’s called a ‘reserve currency’ because so many of the world’s governments hold US dollars to facilitate global trade.

Though no one ever designated the US dollar as the world’s ‘reserve currency,’ it slowly replaced the British pound sterling as the currency most trusted for international transactions. While the US dollar overtook the British pound in the 1950s, it only came to dominate as the world’s reserve currency in the early 1970s, when British officials tried to discourage the use of the pound as a reserve currency upon British accession to the European Economic Community, the forerunner of today’s European Union.

The greenback has remained the world’s reserve currency ever since.

As of the first quarter of 2013, 62.2% of all foreign exchange reserves were in US dollars — that falls somewhere between a low of 59% in 1995 and a high of almost 71% in 2001. The competition isn’t even close — just 23.7% of forex reserves were in euros, and the euro’s use as a reserve currency has fallen significantly since the onset of the eurozone’s own sovereign debt crisis. A basket of other currencies — the British pound, the Japanese yen, the Canadian dollar, the Australian dollar and the Swiss franc –round out the lion’s share of global reserves:

One foundation undergirding the US dollar’s status as a global reserve currency is its role in the global oil trade. Since the early 1970s, the Organization of Petroleum Exporting Countries quotes the price of oil in US dollars, which further boosts demand for US dollars in the international exchange markets. Even if a government doesn’t explicitly want to hold US dollars, for political or other reasons, it’s virtually required to hold them anyway if it’s a net oil importer. Although Iran, Venezuela and some other OPEC countries grumble from time to time about the US dollar’s supremacy, pushing to switch from the US dollar to the euro or a basket of currencies, the ‘petrodollar’ standard doesn’t seem likely to change immediately, especially in light of the cozy relationship between the United States and the world’s largest oil producer, Saudi Arabia.

That has given the United States, for the past forty years, what former French president Valéry Giscard d’Estaing termed an ‘exorbitant privilege’ by reducing the need of the United States to balance its current account deficit. To think of it in yet another way, US dollars are one of the goods that the United States exports. In other words, it allows the United States to run an extended trade deficit. Non-Americans are willing to sell goods and services to the United States in exchange for US dollars rather than US-manufactured goods and services, thereby allowing the United States to import even more without suffering the adverse effects that come with a growing trade imbalance (for an example of some of those adverse effects, take a look at Venezuela’s increasingly import-dependent economy). But since 2008, the US trade deficit is becoming smaller — and with the promise of greater US energy independence by the 2020s through offshore drilling, ‘fracking’ and other technologies, it’s not inconceivable to believe that the United States could have a trade surplus within a decade. That would eliminate one of the chief benefits that the United States enjoys from the US dollar’s dominance as the chief global reserve currency.

One currency that isn’t going to be used anytime soon is the renminbi, because Chinese currency controls limit the free use of the Chinese currency in global financial markets, and the value of the yuan is set by the Chinese authorities — it’s not a free-floating currency whose value is determined in the marketplace like the other global reserve currencies. Although China has moved to internationalize its currency since 2009, it’s in no shape to emerge as a global reserve currency in the short-term.

Nonetheless, China and other developing countries have called on a new reserve currency, including the use of the IMF’s ‘special drawing rights’ — a constructed basket of currencies that’s weighted by several floating currencies. The IMF’s current SDRs are weighted at about 42% US dollar, 37% euro, 9% Japanese yen and 11% British pound.

But it’s unlikely that China or anyone would turn to SDRs or to another national currency anytime soon, and although the Chinese government has lowered the portion of dollar assets in its forex reserves from 69% around three years ago to 49% in mid-2012, its foreign reserves still require the holding of massive amounts of US Treasurys, as described above.

The US dollar’s replacement of the British pound sterling took place over the course of three decades, and the replacement of the US dollar to a new system would almost certainly also take place over an extended period of time. But that day of reckoning might be accelerated if the US political system can’t effectively operate:

There is no viable alternative to the dollar as the centerpiece of the global financial system, and there probably won’t be for the foreseeable future, experts said. But Washington’s debt limit standoff — coming on the heels of similar brinkmanship in 2011 — could accelerate efforts to find an alternative.

“The U.S. remains the core of the global financial system at this point,” said Nicolas Veron, a senior fellow at Bruegel, a think tank in Brussels. “But the sort of thing happening in the U.S. might move people toward a system less reliant on the U.S.”