Italy’s Mario Draghi, the president of the European Central Bank, joined Stanley Fischer, the vice chair of the Federal Reserve, in an hour-long program at the Brookings Institution earlier today.![]()

Draghi addressed at length both the ECB’s steps to confront deflation and the need for EU countries to enact bolder economic reforms in his remarks and in his discussion with Fischer, the former president of Israel’s central bank and a former professor at the University of Chicago who once taught Draghi.

Deflation as Europe’s chief economic threat

Draghi stressed that he understands the biggest risk to European Union’s economic recovery is deflation. He noted that the ECB is transitioning from a more passive approach to a much more active ‘QE-style’ approach to the bank’s balance sheet — in part by moving last month to purchase private-sector bonds and asset-backed securities. Even if Draghi’s efforts still fall short of the kind of quantitative easing (e.g., outright asset purchases) that the Federal Reserve introduced to US monetary policy five years ago, Draghi committed himself to lifting the eurozone’s inflation from ‘its excessively low level’:

Draghi stressed that he understands the biggest risk to European Union’s economic recovery is deflation. He noted that the ECB is transitioning from a more passive approach to a much more active ‘QE-style’ approach to the bank’s balance sheet — in part by moving last month to purchase private-sector bonds and asset-backed securities. Even if Draghi’s efforts still fall short of the kind of quantitative easing (e.g., outright asset purchases) that the Federal Reserve introduced to US monetary policy five years ago, Draghi committed himself to lifting the eurozone’s inflation from ‘its excessively low level’:

We will do exactly that.

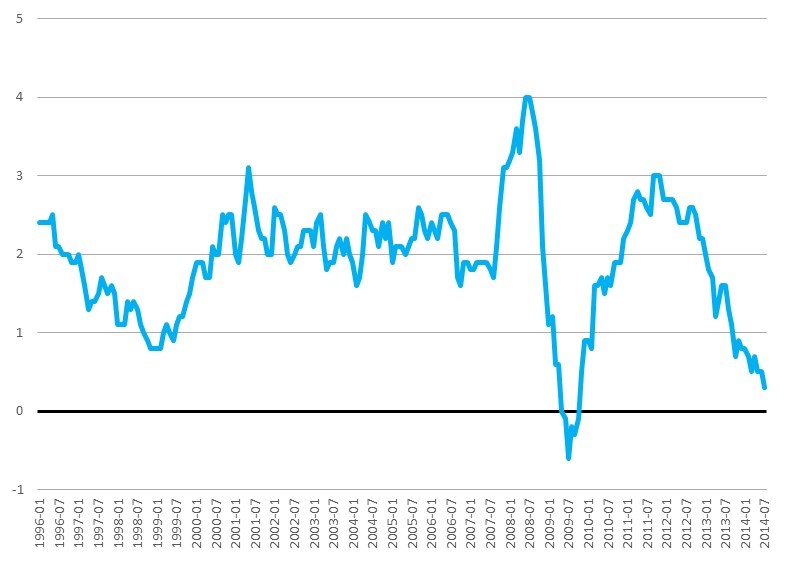

It’s not exactly ‘whatever it takes,’ but it’s a sign that Draghi realizes the dangers that deflation presents, with the eurozone inflation rate falling to just 0.3%, the lowest level since the height of the eurozone’s existential sovereign debt crisis:

Draghi has been one of the leading voices for a more active ECB approach to boosting inflation to 2% within the next two years, though Germany’s powerful central bank, the Bundesbank, and its president Jens Weidmann (also a member of the ECB’s 24-person governing council), remains skeptical of full-throated quantitative easing. Continue reading ECB’s Draghi on raising inflation in Europe: ‘We will do exactly that.’