When Venezuelan president Nicolás Maduro appointed Nelson Merentes as his new finance minister shortly after Maduro’s controversial election in April, no one knew whether Merentes would actually be the official in charge of economic policy.![]()

That’s because the former finance minister Jorge Giordani, the longtime policymaker in the era of former president Hugo Chávez, remained planning secretary — and in a huge public-sector country like Venezuela, there’s little left untouched by central planning. Giordani, more than anyone else, was responsible for the statist economic policies of the Chávez era, including currency and price controls.

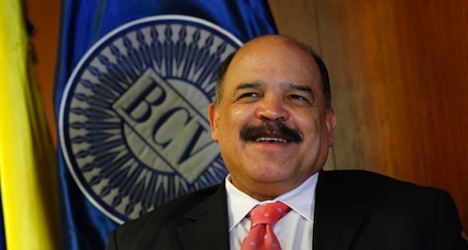

But this week, there was no mistaking that Merentes is now ascendant — Edmée Betancourt, who had served as president of Venezuela’s central bank (BCV) for just over three months, stepped down in favor of Eudomar Tovar, an economist who was most recently the head of Venezuela’s currency exchange (CADIVI). Betancourt, a former commerce minister, was seen as closer to Giordani and the more ideological, statist wing of chavismo, while Tovar and Merentes are associated with a more pragmatic, moderate view of economic policy. Rumors swirled last week that Giordani might soon leave the planning ministry, abandoning a recent push to raise taxes, to take up an ambassadorship soon.

Leave aside for a moment that in an era of central bank independence, neither Giordani nor Merentes would be dominating the BCV’s monetary policy in a country with sounder financial institutions. If Merentes and Maduro really want to shake up Venezuela’s economy for the better, they should start by reintroducing a line between the ruling Partido Socialista Unido de Venezuela (PSUV, United Socialist Party of Venezuela) and the institutions of the Venezuelan state — starting with the BCV, but also with the national oil company, Petróleos de Venezuela, S.A. (PDVSA).

Merentes’s rise should provide at least some cautious optimism — if Giordani would have doubled-down on statist Chávez-era policies, at least Merentes seems to realize that Venezuela’s basketcase economy has some problems. The central bank’s reserves are dwindling, Venezuelan GDP growth has slowed to nearly nothing, and inflation has reached its highest level since before Chávez came to power in 1999 on the road to a potential hyperinflationary collapse.

But it remains far from clear that Merentes is willing to embark upon a program of true economic reform or whether Maduro has both the political capital and the political will to enable him to do so. Moves to devalue the bolívar both officially and unofficially earlier this year was a start in bringing the Venezuelan currency’s stated value in line with its real market value, but the currency has decline further in value throughout they year: despite an official value of 6.3 bolívares to the dollar, its real value has dropped from around 20 at the time of the April 14 election to more than 30 or 35 today. Maduro took steps to tweak the currency exchange system through the introduction of SICAD auctions earlier this spring — because the vast majority of U.S. currency comes to Venezuela through the government’s sale of oil products, the government must develop a mechanism to sell those dollars to importers who need hard currency. But neither Maduro nor Merentes have been in a rush to hold regular dollar auctions (only around $600 million has been auctioned off so far in 2013) or to deliver the actual dollars from the government to the private sector. But the fuss over SICAD and currency exchange is really just a stop-gap measure — if the ‘pragmatists’ can’t even get this right, it leaves little faith in their ability to overcome more fundamental problems with Venezuela’s economy.

Maduro and Merentes still hope that they can borrow their way out of Venezuela’s current malaise, and the government had the brass to float the possibility two months ago that Merentes would go on a roadshow to New York and London to gauge appetite for Venezuelan bonds. That roadshow plan quickly fell apart when it became clear that there’s little appetite for risky Venezuelan debt among global investors — yields on Venezuela’s benchmark bond have been in the double digits since Maduro’s election.

What Venezuela needs most of all is serious economic reform, and it doesn’t seem that the economy can afford to wait until the opposition takes power at the next election in 2018 (or even by recalling Maduro in 2016) — a reduction in oil subsidies abroad and at home, massive anti-inflationary efforts that are sapping whatever meager GDP growth the country is managing, a plan to boost exports and reduce dependence on imports, major foreign investment in PDVSA (or at least an end to using PDVSA’s cash flows to fund inefficient and corrupt government programs at the expense of reinvestment), the reinforcement of property rights and a business climate where the private sector need not fear expropriation from one episode of ‘Aló Presidente’ to the next. None of that need be inconsistent with funding misiones for health care or education among Venezuela’s poorest nor is it consistent with the value that Venezuela’s oil wealth should be shared among society more equitably.

There’s some sign that PDVSA is moving in the right direction under the powerful energy minister Rafael Ramírez, who signed a $2 billion deal two months ago with U.S.-based Chevron to develop an oil field in Zulia state, which followed a $4 billion Chinese loan and a $1.5 Russian loan to develop the Orinoco field in May. But those investments won’t bear immediate fruit, and even if they do, it’s not clear that Maduro and Merentes won’t continue to treat PDVSA as another piggy bank to raid. And a plan to raise the interest rate from 1% to 2% on the loans that Venezuela fronts to PetroCaribe countries to subsidize oil purchases from Central American and Caribbean countries is not exactly the kind of radical move that could truly boost Venezuelan finances.

Even as Merentes seems to be winning out over Giordani, there are still true believers within the chavista high guard, including Elías Jaua, Venezuela’s foreign minister and a former vice president, though he’s not one of the key voices on economic policy. Arguably, the most power chavista in Venezuela isn’t even Maduro, it could well be Diosdado Cabello, the president of the Asamblea Nacional (National Assembly), whose only ideological fealty has been to Diosdadism.

One thought on “‘Pragmatic’ Merentes winning control over Venezuela economic policy, but to what end?”